Here’s an in‑depth overview of MAPFRE — what it is, what it offers, and why it’s considered one of the major global insurance groups.

🏛️ What is MAPFRE

- MAPFRE was founded on May 16, 1933, originally in Spain as a mutual insurance company. (Wikipedia)

- Today, MAPFRE is a large multinational insurance group, headquartered in Majadahonda, Madrid. (Wikipedia)

- It has grown significantly over decades — expanding from its early agricultural‑insurance roots into a global insurer operating in many countries. (MAPFRE)

- MAPFRE is the largest Spanish‑owned insurer globally and one of the leading international insurance groups in Latin America. (Mapfre Turquia Sigorta)

🌍 Global Reach & Scale

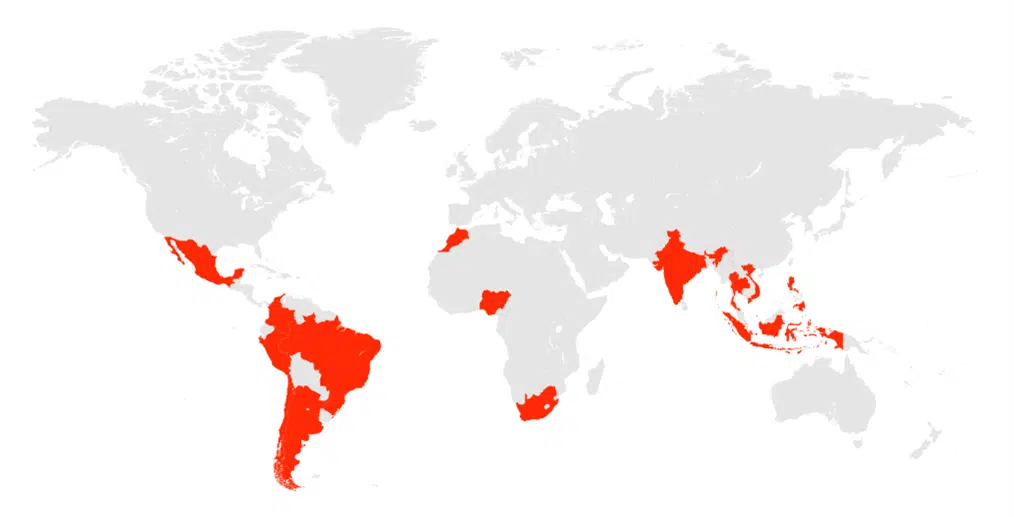

- MAPFRE operates in dozens of countries across all five continents. (Mapfre Insurance)

- It serves tens of millions of clients worldwide and employs tens of thousands of staff. (MAPFRE)

- The Group is active not only in Spain and Europe but also has a strong presence in Latin America — where it is among the largest insurers — and it has penetration in markets like the United States (via its subsidiary). (Wikipedia)

In short: MAPFRE is a truly global insurance group, capable of serving both individual customers and businesses across many regions.

📄 What Services and Products MAPFRE Offers

MAPFRE’s portfolio is broad, covering many kinds of insurance and financial‑service needs. Key offerings:

- Life Insurance & Non‑life Insurance — MAPFRE covers traditional life insurance, as well as non‑life areas: property, auto, general‑insurance risks. (Forbes)

- Health & Medical Insurance — Especially in certain countries and regions (e.g. parts of Europe and Latin America), MAPFRE offers health‑insurance coverage. (MAPFRE)

- Pension, Savings & Investment Services — Through its asset‑management and financial‑services divisions, MAPFRE offers savings, pensions, and investment products. (Mapfre AM)

- Corporate / Business Insurance & Risk Solutions — For businesses, professionals, and enterprises: property, liability, commercial‑risk insurance, potentially global business‑risk coverage. (Mapfre Insurance)

- Reinsurance & Global Risk Services — MAPFRE also operates in reinsurance (insuring insurers / large risks) and global‑risk management frameworks. (MAPFRE)

In effect, MAPFRE is a full‑spectrum insurance and financial services provider: from basic auto/home insurance to life & health, business risks, pensions, and investments.

✅ Why MAPFRE Is Considered a Strong & Respected Insurance Group

- Long history & broad experience — almost a century since founding; evolved successfully from local mutual to global group.

- Global presence & diversification — by operating across continents and markets, MAPFRE spreads risk and gains stability beyond any one country.

- Wide portfolio of services — customers can get many types of insurance and financial services under the same group, which brings convenience and integration.

- Strong market presence in key regions — leading insurer in Spain, major footprint in Latin America, presence in US and other international markets.

- Adaptability and resilience — MAPFRE has expanded through different lines (life, non‑life, reinsurance, investments), which helps withstand changing economic and regulatory climates.

⚠️ What to Know / What to Check If Considering MAPFRE

- Offerings may vary by country/region — health‑insurance plans, coverage extent, and availability depend a lot on local regulations and markets. What exists in Spain or Latin America may not work the same elsewhere.

- Complexity of services — with many product lines (insurance, investments, pensions), it’s important to read policy details carefully: what’s included, what’s excluded, costs vs benefits.

- Cost vs benefit trade‑offs — higher coverage or more comprehensive plans (health + life + asset management etc.) may come with higher premiums or fees.

- Local support & network matter — for health or property insurance, the quality and accessibility of hospitals, clinics or repair networks in your area are crucial.

🎯 Who MAPFRE Is Best For (Ideal Use Cases)

MAPFRE is a good match if you:

- Want a single, well‑established multinational insurer that offers many types of insurance — life, health, property, auto, corporate, etc.

- Live (or travel/work) in Spain, Latin America, or a country where MAPFRE has operations, so you can get full benefit of their network and offerings.

- Need both personal and business insurance — e.g. individual life/health cover or business liability/property cover.

- Want long‑term financial planning — using their pension, savings, or investment products along with insurance.

- Prefer a diversified, globally present insurer rather than a small local company — which can add stability and reliability.